oklahoma franchise tax due date 2021

Any taxpayer with an Oklahoma franchise tax liability due and payable on or before July 1 2021 will be granted a waiver of any penalties andor interest for returns filed by August. The return will not be considered late until after september15th of the calendar year.

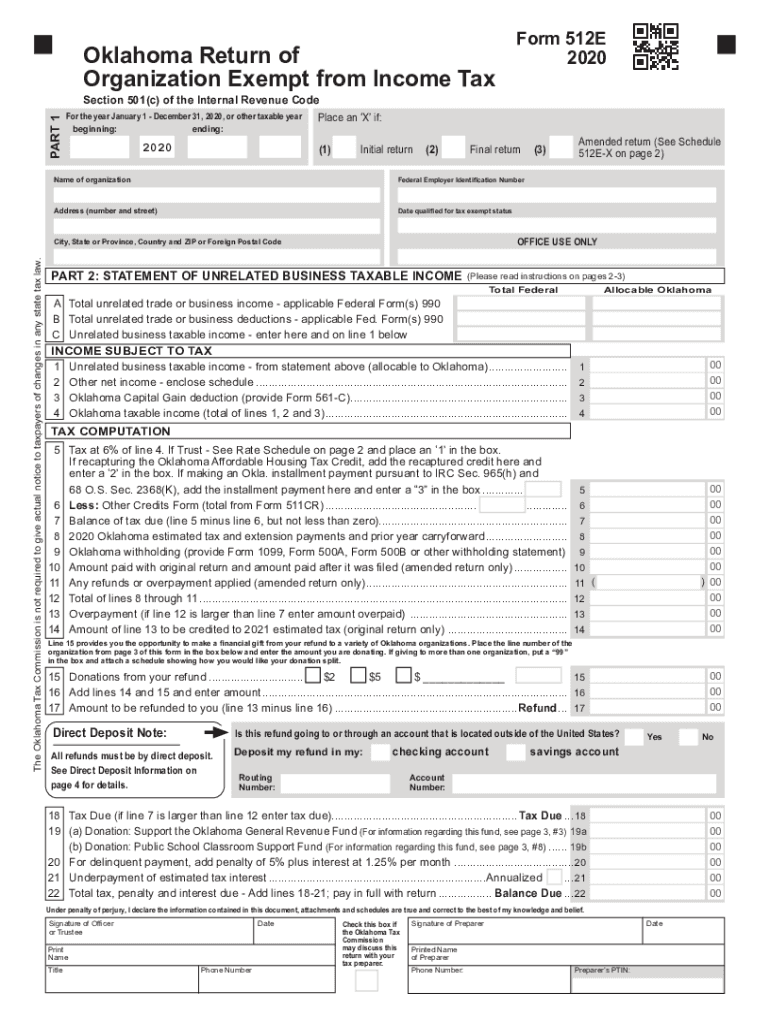

Oklahoma Return Of Organization Exempt From Income Tax Form Fill Out Sign Online Dochub

The due date will be the next business day if may 15th 2022 falls on a weekend or holiday ie may 16th 2022.

. Your Oklahoma return is due 30 days after the due date of your federal return. This form is used to notify the Oklahoma Tax Commission that the below named corporation is electing to. Any taxpayer with a payment due by March 15 2021 andor April 15 2021 for 2020 Oklahoma income taxes andor any estimated 2021 income tax payment due by March 15.

2019 Oklahoma Corporation Income and Franchise Tax Forms State of Oklahoma 2021 Form 514 Oklahoma Partnership Income Tax Return Packet Instructions. Franchise Tax Payment Options New Business Information New Business Workshop Forming a Business in Oklahoma Streamlined Sales Tax Forms. Mail Form 504-C Application for Extension of Time to File an Oklahoma.

The due date will be the next business day if may 15th 2022 falls on a weekend or holiday ie may 16th 2022. File the annual franchise tax using the same period and due date of their. Oklahoma franchise tax due date 2021 thursday february 24.

The Oklahoma Tax Commission has granted relief to taxpayers affected by the severe winter storms that began on February 8 2021. The most secure digital platform to get legally binding electronically signed. Fill out securely sign print or email your oklahoma form franchise tax 2015 instantly with signNow.

The remittance of estimated franchise tax must be made on a tentative estimated franchise tax return Form 200. Tags Federal And State Tax. 31 2021 can be.

See page 14 for methods of contacting the Oklahoma Tax Commission OTC. Oklahoma franchise tax due date 2021 thursday february 24. No Tax Due Threshold.

Oklahoma Franchise Tax Return Due Date. Tax Rate other than retail or wholesale 075. He said the states June 15 extension applies to personal 2020 income tax returns franchise tax returns and 2021 income tax estimates.

In granting relief the Commission took. Tax Rate retail or wholesale 0375. OK tax return filing and payment due date for Tax Year 2021 is April 18 2022Oklahoma State Individual Taxes for Tax Year 2021 January 1 - Dec.

Download or print the 2021 Oklahoma Form 512 Corporate Income Tax Return form and schedules for FREE from the Oklahoma Tax Commission. Paper filed returns are due april 15. 2021 Form 512 Oklahoma.

Depending on the volume of sales taxes you collect and the status of your sales tax account with Oklahoma you may be required to file sales tax returns on a monthly semi-monthly quarterly.

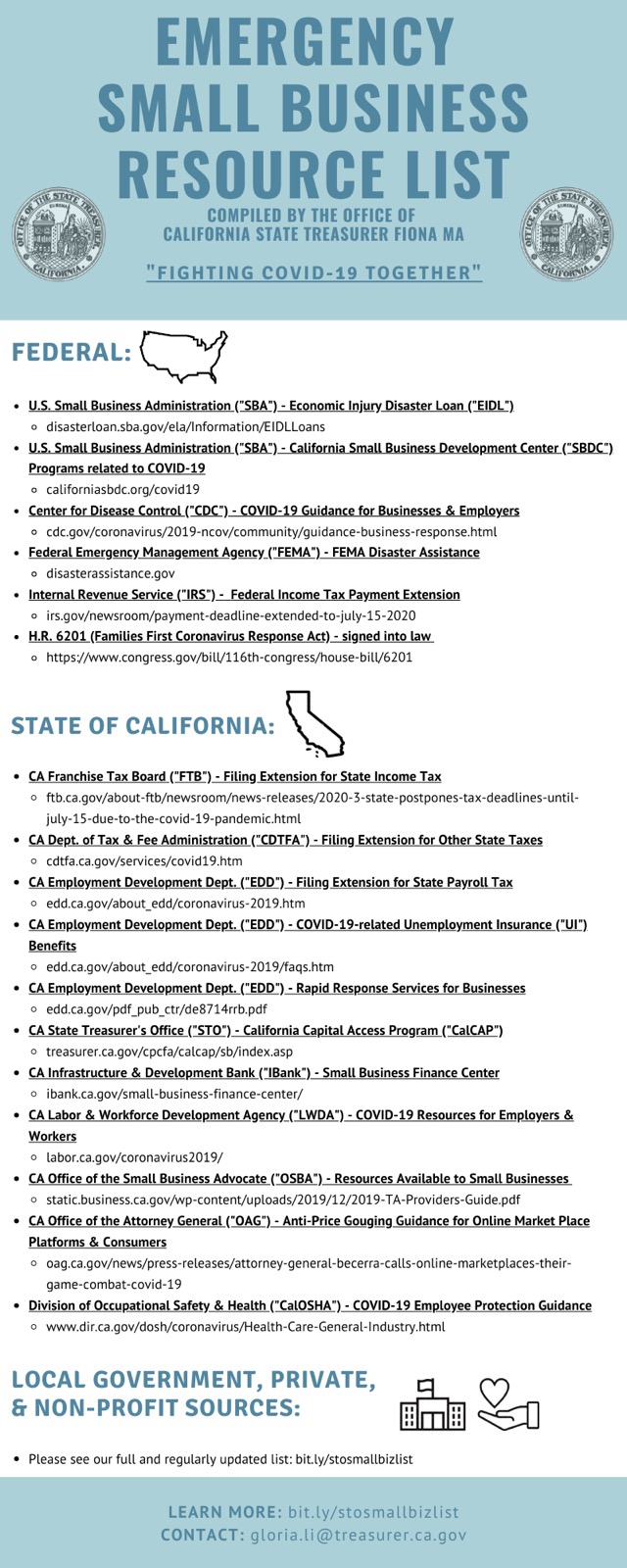

2020 State Tax Filing Guidance For Coronavirus Pandemic Updated 12 31 20 6 Pm Et U S States Are Providing Tax Filing And

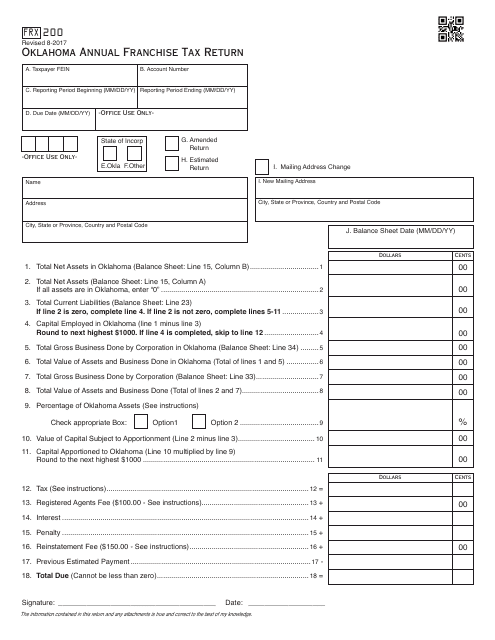

Otc Form Frx200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

Irs Not Budging April 15 Is The Deadline For 2021 S First Estimated Tax Payment Don T Mess With Taxes

Incorporate In Oklahoma Do Business The Right Way

2021 Tax Filing Deadline Extended For Texas Oklahoma And Louisiana

State Corporate Income Tax Rates And Brackets Tax Foundation

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

Free Oklahoma Tax Power Of Attorney Form Bt 129 Pdf Eforms

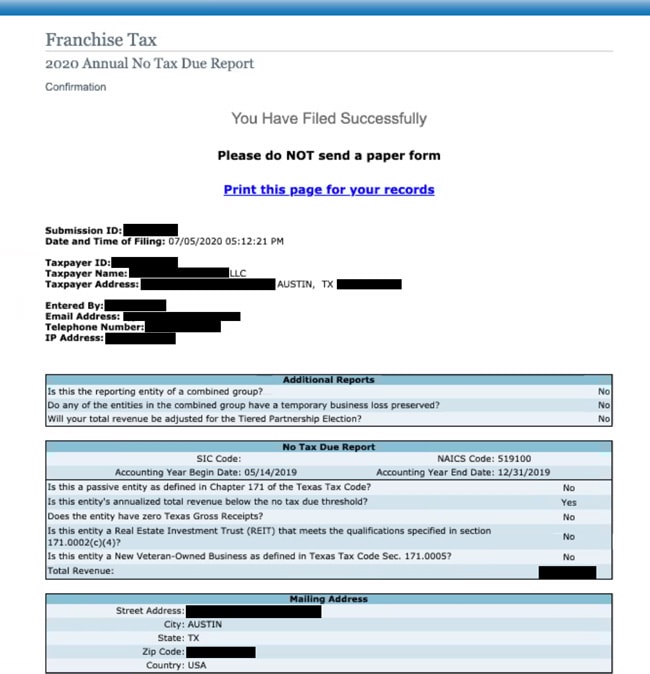

Texas Llc No Tax Due Public Information Report Llcu

Corporate Income Taxes Urban Institute

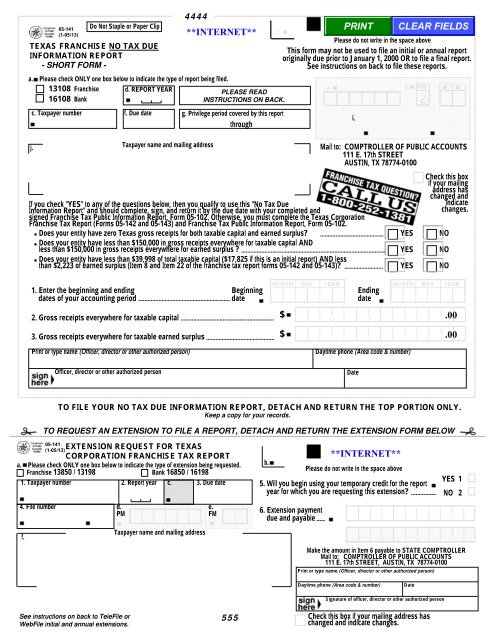

05 141 Franchise Tax No Tax Due Information State Legal Forms

California Tax Forms H R Block

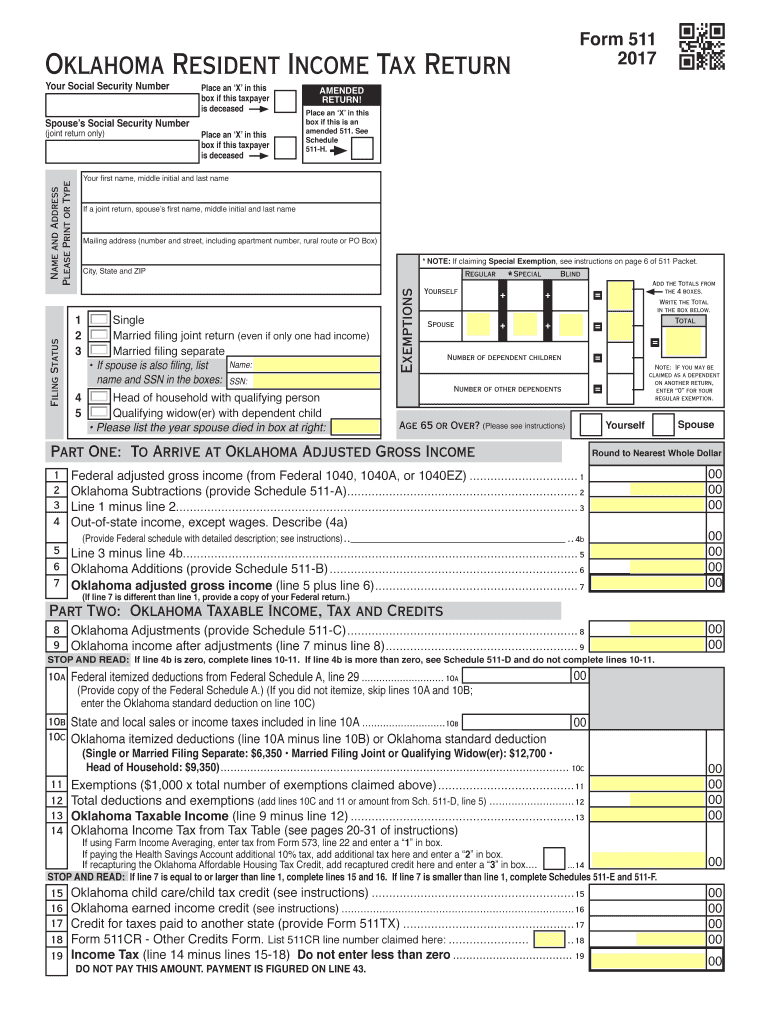

Oklahoma Resident Tax Form 511 2014 Fill Out Sign Online Dochub

Why Zero Par Value Stock Affects Franchise Tax Harvard Business Services

Llc Tax Calculator Definitive Small Business Tax Estimator

Businesses In Texas Get Extra Time To File Franchise Tax Returns C Brian Streig Cpa

Irs Extends Tax Deadlines For Texas Residents And Businesses Mc Gazette