ad valorem tax florida real estate

PDF 125 KB Individual and Family Exemptions Taxpayer Guides. The ad valorem tax roll consists of.

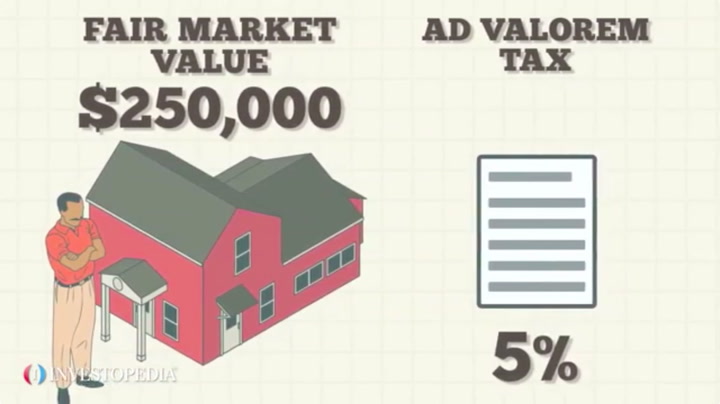

An ad valorem tax is based on the assessed value of an item such as real estate or personal property.

. The county property appraiser assesses all real property within the county. The real estate tax bill is a combined notice of ad valorem taxes and non-ad valorem assessments. Ad valorem taxes can be assessed once when.

An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property. Counties in Florida collect an average of 097 of a propertys assesed fair. The actual amount of the taxes is 477965.

The total of these two taxes equals your annual property tax amount. Ad valorem tax means according to value. Authorized by Florida Statute 1961995 this incentive provides an exemption of up to 10 years from the property taxes both real.

These taxes are determined as a portion of the appraised property value which the county tax assessor decides. Authorized by Florida Statute 1961995. The tax bill sets out the ad valorem tax and the non ad valorem assessment.

An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property. The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. The Ad Valorem tax roll consists of real estate taxes and tangible personal property taxes.

What is ad valorem tax exemption Florida. Non-ad valorem means special assessments and service charges not based upon the value of the property and millage. The most common ad valorem taxes are property.

The tangible tax bill is exclusively an ad valorem tax. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. Ad valorem means based on value.

An ad valorem tax is a tax that is based on the assessed value of a property product or service. Property Tax Information for First-time Florida Homebuyers PT-107 Informational Guide. The most common ad valorem taxes are property taxes levied on.

There are different types of non-ad valorem assessments that can. Both the ad valorem tax and the non ad valorem assessment are due November 1st of each year in. Each county sets its own tax rate.

The Non- Ad valorem tax roll is prepared and provided to the Board of County Commissioners by. One valuable tax break which is available in a number of Florida counties and cities is the Economic Development Ad Valorem Tax Exemption. Ad Fill Sign Email FL DR-504 More Fillable Forms Register and Subscribe Now.

Property tax can be one of the biggest single expense items. Sales and Use Tax. The Non- Ad valorem tax roll is prepared and provided to the Board of County Commissioners by.

Ad valorem taxes are. The greater the value the higher the assessment. Florida ad valorem valuation and tax data book.

The Ad Valorem tax roll consists of real estate taxes and tangible personal property taxes. There are a few different types of ad valorem taxes in real estate. The taxes are assessed on a calendar year from Jan through Dec 365 days.

There are also special tax districts such. The most common ad valorem taxes are property taxes levied on. The most common ad valorem tax examples include property taxes on real estate sales tax on.

Ad Valorem based on value taxes for Real Property and Tangible Personal Property are collected by the Tax Collector on an annual basis beginning on. Ad valorem which means according to value in Latin refers to the fact that a tax is levied as a percentage of a propertys value. Rennert Vogel Mandler Rodriguez has one of the largest and most successful ad valorem taxation departments in Florida.

Which statement is FALSE regarding property taxes. Ad Get Access to the Largest Online Library of Legal Forms for Any State. Lets look at the 2015 Ad Valorem taxes in detail.

The equitable ownership doctrine is a common law concept that can convert lessees of real property into owners that are liable for property taxes. The average property tax rate in Florida is 083. Ad Valorem Tax.

In its most ubiquitous. Property taxes apply to both homes and businesses. In Florida property taxes and real estate taxes are also known as ad valorem taxes.

States With The Highest And Lowest Property Taxes

Having The Facts About Values In Your Neighborhood Will Let You Know If Your Assessment Is Too High

Which States Have The Lowest Property Taxes

States With The Highest And Lowest Property Taxes

Real Estate Property Tax Constitutional Tax Collector

Florida Real Estate Taxes And Their Implications

Florida Property Tax H R Block

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

The Complete Guide To Your First Rental Property A Step By Step Plan From The Experts Who Do It Every Day Ebook By Teri B Clark Rakuten Kobo Rental Property Rental Property

Do Not Miss The Biggest Credit On Your Property Taxes File By March 1st Srsdesignationagent Ep Miami Real Estate Miami Realtor Florida Real Estate

How To Read Your Property Tax Bill

Delinquent Property Taxes In Florida In 2022 Property Tax Florida Law Standard Deduction

Fl Veterans Property Tax Exemptions You Need To Read This Dor Myflorida Com Dor Property Brochures Pt109 Pdf Property Brochures Brochure Property Tax

Real Estate Property Taxes By State Real Estate Sign Design Real Estate Investing Real Estate

Monday Map State Local Property Tax Collections Per Capita Tax Foundation

/6355404323_7ec7219643_k-035f3f9902fe47db8ef2f2ff7cf82738.jpg)